Investment Attributes: Patience

There are certain attributes that a person can develop to help them in any activity. To use a sports analogy there are certain muscles or body systems that are key for certain sports. You don't need endurance for weightlifting and you don't need incredible power for long distance running.

Patience in investing is vital and also very difficult. When things move both in good and bad directions it is very difficult to not react. Emotion is the enemy of patience. Knowing yourself and being in tune with your emotions is more important than any external stimulus or statistic. Quantitative measures or hiring a professional is one way to take the emotion out of investing but that does not help the individual who wants to run their own portfolio. Below I share 5 things that have helped me overcome emotion and remain more patient.

1. Only allow yourself to buy a security that is down for the day

2. Only allow yourself to sell a security that is up for the day

3. Step away for a week or more (don't look at anything market related, especially your holdings)

4. Ask a friend for a critical, alternative view

5. Pre-specify what prices you will sell at when you buy (both an up and a down number)

I made-up the first two rules about 5 years ago and they have been the a better deterrent for emotional trading than I would have thought. The idea is you are always trading against what the market is saying that day.

When I go on vacation I do not let myself watch the financial news or check my stocks. I was actually on a three month sabbatical during the Brexit announcement and did not even realize it happened. Everything went down and came back and was basically at the same place when I left and when I returned.

Friends can be a great source of alternative advice. Nothing deflates emotion like someone telling you the "other" side of the story.

The last one is not something I use but I have heard others set a target return and a max acceptable loss when they buy something and they say that gives them discipline.

I hope these ideas help you as you seek to take emotion out of your investment decisions.

So what are the skills or attributes needed to be a good investor? I will list a number of them and will try to talk about one each month going forward.

In my opinion the following attributes are key to becoming a successful investor.

Curiosity, Patience, Humility, Conviction, and Discipline

Patience:

Patience in investing is vital and also very difficult. When things move both in good and bad directions it is very difficult to not react. Emotion is the enemy of patience. Knowing yourself and being in tune with your emotions is more important than any external stimulus or statistic. Quantitative measures or hiring a professional is one way to take the emotion out of investing but that does not help the individual who wants to run their own portfolio. Below I share 5 things that have helped me overcome emotion and remain more patient.

1. Only allow yourself to buy a security that is down for the day

2. Only allow yourself to sell a security that is up for the day

3. Step away for a week or more (don't look at anything market related, especially your holdings)

4. Ask a friend for a critical, alternative view

5. Pre-specify what prices you will sell at when you buy (both an up and a down number)

I made-up the first two rules about 5 years ago and they have been the a better deterrent for emotional trading than I would have thought. The idea is you are always trading against what the market is saying that day.

When I go on vacation I do not let myself watch the financial news or check my stocks. I was actually on a three month sabbatical during the Brexit announcement and did not even realize it happened. Everything went down and came back and was basically at the same place when I left and when I returned.

Friends can be a great source of alternative advice. Nothing deflates emotion like someone telling you the "other" side of the story.

The last one is not something I use but I have heard others set a target return and a max acceptable loss when they buy something and they say that gives them discipline.

I hope these ideas help you as you seek to take emotion out of your investment decisions.

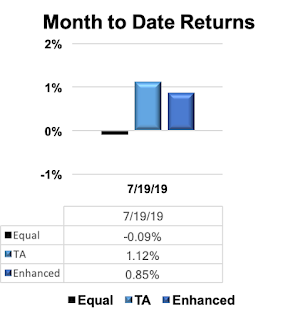

PORTFOLIO UPDATE (as of 7/19/2019):

Current Performance:

The ETF's and other funds that make up the portfolio's MTD Returns:

Portfolio Description:

The first is a "buy and hold" strategy that does not ever change. I call this the Equal portfolio because it is made up of four equal parts allocated to different asset classes. It is 1/4 in large cap equity (Ticker VONE), 1/4 in small cap equity (Ticker VTWO), 1/4 in investment grade debt (Ticker AGG), and 1/4 in high yield debt (Ticker JNK). The allocations never change. The only thing needed is to rebalance every so often as performance differences will cause the weights to shift.

The second portfolio is a "tactical" portfolio. It is tactical because it adjusts the weights to the four asset classes above based on market conditions. I call this the TA portfolio. It can go 100% into any one asset class or be a mixture of them. 1/12th of this portfolio can change each month as I make a monthly call on what i expect will do best over the next year based on current market conditions. Historically I have picked the best asset class about 50% of the time, the second best about 25% of the time, the third best 18% of the time and the worst 7% of the time.

The third portfolio is also a "tactical" portfolio. I call it the Enhanced portfolio because I follow the same allocation as the TA portfolio but I pick other vehicles that I expect to offer a better return than the four ETF's used in the Equal portfolio. This allows for active management and broader exposure to asset classes such as International Equities, Emerging Markets, and Commodities among others.

Current Allocations:

Current Performance:

The ETF's and other funds that make up the portfolio's MTD Returns:

| Ticker | 7/19/19 |

| VONE | 1.4% |

| VTWO | -0.9% |

| JNK | -0.8% |

| AGG | -0.2% |

| IEMG | 0.1% |

| DVY | 0.8% |

| JXI GOVT | 0.6% -0.4% |

Portfolio Description:

The first is a "buy and hold" strategy that does not ever change. I call this the Equal portfolio because it is made up of four equal parts allocated to different asset classes. It is 1/4 in large cap equity (Ticker VONE), 1/4 in small cap equity (Ticker VTWO), 1/4 in investment grade debt (Ticker AGG), and 1/4 in high yield debt (Ticker JNK). The allocations never change. The only thing needed is to rebalance every so often as performance differences will cause the weights to shift.

The second portfolio is a "tactical" portfolio. It is tactical because it adjusts the weights to the four asset classes above based on market conditions. I call this the TA portfolio. It can go 100% into any one asset class or be a mixture of them. 1/12th of this portfolio can change each month as I make a monthly call on what i expect will do best over the next year based on current market conditions. Historically I have picked the best asset class about 50% of the time, the second best about 25% of the time, the third best 18% of the time and the worst 7% of the time.

The third portfolio is also a "tactical" portfolio. I call it the Enhanced portfolio because I follow the same allocation as the TA portfolio but I pick other vehicles that I expect to offer a better return than the four ETF's used in the Equal portfolio. This allows for active management and broader exposure to asset classes such as International Equities, Emerging Markets, and Commodities among others.

Current Allocations:

DISCLAIMER:

Past performance is not a guarantee of future performance. This strategy is presented for informational purposes only and is not a solicitation to buy or sell any securities. The writer of this blog owns many (long positions only), if not all, of the securities discussed in this blog. October is one of the peculiarly dangerous months to speculate in stocks in. The others are July, January, September, April, November, May , March, June, December, August and February. ~ Mark Twain

Comments

Post a Comment