Dec 2nd, 2019 Allocation

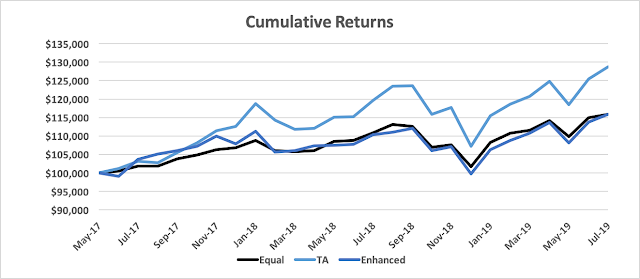

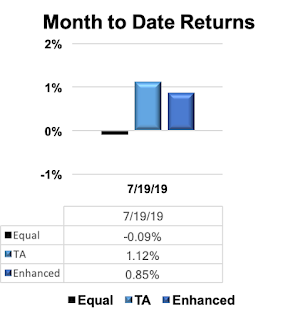

No Trades on Dec 2nd. The markets have been fluctuating for the past six months, one month indicators say to reduce risk the next they say to hold course. This has led to a slower than normal reduction in risk but it has benefited the portfolio returns. This month we are showing to "hold the course" although I expect we will continue reducing risk in coming months. The Equal portfolio: No trades. The TA portfolio: No Trades. The Enhanced portfolio: No Trades. Current Allocation: Large Cap Equity (VONE): 67% Small Cap Equity (VTWO): 0% High Yield Debt (JNK): 0% Inv. Grade Debt (AGG): 33% Equal Weight Portfolio: VONE = 225 Shares VTWO = 234 Shares AGG = 248 Shares JNK = 264 Shares TA Portfolio: VONE = 622 Shares AGG ...