Why Today?

"Compound interest is the most powerful force in the universe"

Procrastination is a basic trait of human nature that I think most people struggle to overcome. When it comes to savings, procrastination has a much higher cost than we understand because we do not fully understand the power of compound interest.~ Albert Einstein

I like to use examples as it is easier to think in terms of real numbers. For a 20 year old, retirement is a long way off. At this age finances are tight, we do not have much spare money. We also have lots of expenses and needs as we begin paying for higher education and our own transportation and within a few years a home and kids. It is easy to understand why very few start saving for retirement when they are very young but...

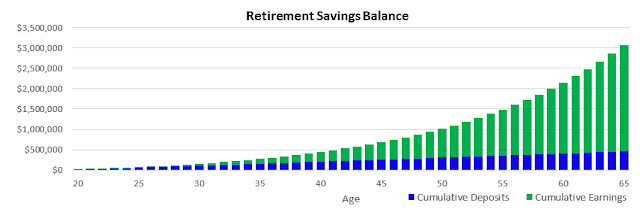

The true cost of procrastinating can be many times the amount we set aside!The chart below is the expected retirement savings balance of a 20 year old. It assumes they invest $10,000 per year and earn a 7% return. For purposes of this discussion I will call the $10,000 that the person puts into their account each year "deposits" (this is money they would have otherwise had to spend) and the increase on that money (that comes from investing it) "earnings". I have separated the amount that has come from deposits and from earnings in the graph below.

The total balance after 45 years is a whopping $3.1 million dollars and most ($2.6 million) of that is from earnings and not deposits. It is also easy to see that most of those earnings came in the later years. This is critical to understand because, if we procrastinate 1 year to begin our deposits we sacrifice the last years' worth of earnings as well as the $10,000 that we did not put into the account.

Procrastinating saving today costs us the deposit plus the last year's earnings!Now let's turn the chart around to look at the annual cost (earnings and deposits) for each year we delay.

Waiting until we are 21 costs us $200,024 plus the $10,000 that we did not save ($210,024). The true cost is more than 20 times the deposit. This happens because we now only have 44 years (instead of 45years) to have our earnings compound. Delaying an additional year adds $186,284 +$10,000 ($196,284) to our cost. Each year delay cuts off another year of compounding our earnings.

The final chart shows the total cumulative cost of procrastinating for 10 years. In this example, the cost of procrastinating 10 years is over $1.6 million dollars.

It is difficult to save but the cost of waiting is very high. Do yourself a favor and make saving a priority today.

Comments

Post a Comment