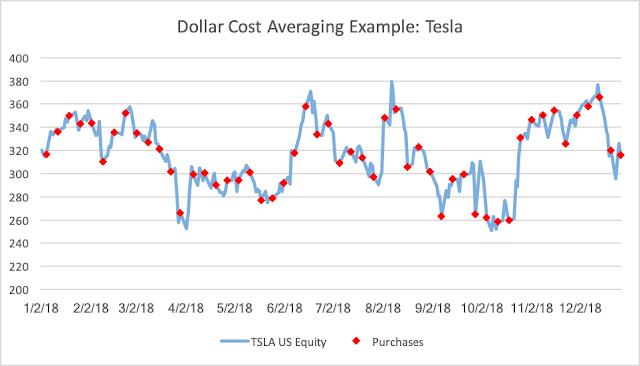

How Does Dollar Cost Averaging Work?

Dollar cost averaging simply means that you buy the same dollar amount of a security at regular intervals. Example: You buy $1000 of Tesla stock every Friday for a year. Why do it? This is easiest to highlight with a real life example. You buy $1000 of Tesla stock every Friday for 52 weeks. You start on January 5, 2018 when the price was 316.58 You end on January 4, 2019 when the price was 316.13 Was this a profitable investment strategy? If you had bought on 1/5/18 and sold on 1/4/19 you would have had a small loss because the price was slightly lower. However because of Dollar Cost Averaging we actually made $560 and had an internal rate of return (IRR) of 2.2%. How is this possible? By holding the dollar amount invested constant we bought more shares when the price was low and less shares when it was high. Example: On February 2nd, when the stock price was $343.75 we only bought 2.91 shares of stock but on October 12th, when the price was $258....