July 31, 2018 Allocations

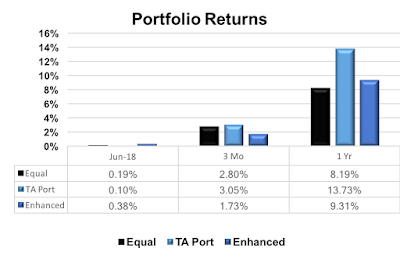

Monthly Portfolio Update: There, again, is no change to the tactical allocation for August: Large Cap Equity: 100% Small Cap Equity: 0% High Yield Debt: 0% Inv. Grade Debt: 0% The Equal portfolio: There is $1231.01 in this account so it is time to put some of that money to work in the asset classes that have underperformed. I will invest approximately half into JNK and half into AGG. I will do the AGG trade first as it has the higher price (this helps reduce the amount of cash left over after the trades) The TA portfolio: There will be no trades in this portfolio. The Enhanced portfolio: The purchase I made one year ago was KXI. This is a global consumer staples ETF. I am going to maintain this exposure so there will be no trades in this portfolio for July. Disclaimer: Past performanc...